U.S. equity markets turned in another strong performance last week. According to FactSet, approximately 84% of S&P 500 companies that have reported second quarter earnings are beating analysts estimates. Unfortunately, layoffs are looming suggesting the economic fallout from the pandemic may last much longer than originally thought.

Consumer spending rose in July but much more slowly than in prior months. U.S. consumers are expected to tighten their purse strings more in August. With the enhanced unemployment checks ending in July and no agreement in Washington for the next round of financial assistance for Americans, consumers have much to be concerned about. All this as the summer wraps up and we move into September. Historically speaking, September has been the single worst-performing month for the S&P 500 Index and the Dow Jones Industrial Average.

One question I have been asked quite a bit lately is, how will the upcoming presidential election affect the markets. With the Republican National Convention wrapping up last Thursday and the Democratic National Convention the week before, election season is now in full swing. Although like many things in 2020, electioneering looks much different than in years past. The economy and, to a lesser degree, the market are major topics in any election year. And with unemployment reaching its highest level since the Global Financial Crisis along with the economy still in recovery, this year seems to be no different. Election season is often thought of as a volatile period for the markets as investors try to ascertain the financial and economic impact of the candidates’ various policy proposals while also trying to handicap who will ultimately win and be in a position to act on those proposals.

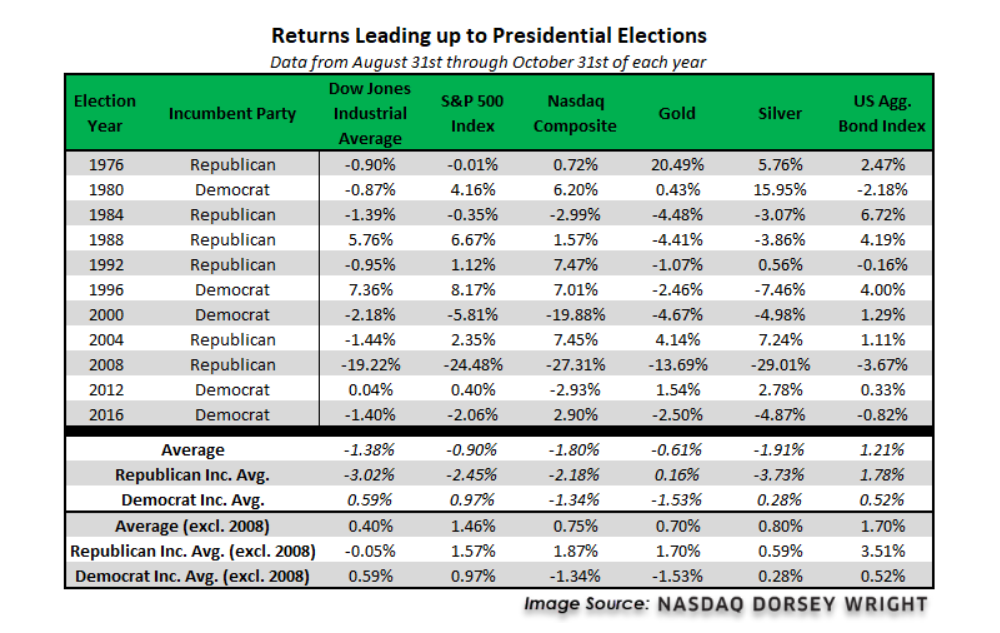

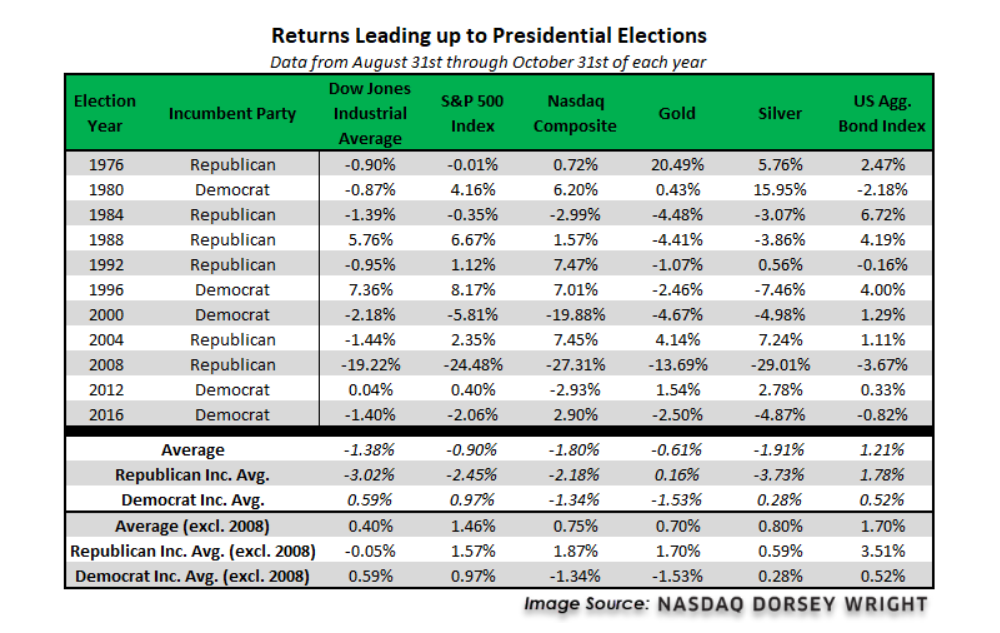

We’ve started to see predictions of increased volatility in the media. Bloomberg, for example recently published an article titled “Markets Brace for US Election Volatility. Well, Some of Them.” In times of market volatility, we often see a risk-off shift as investors look to safe havens like gold and bonds. So let’s examine how various assets – the three major U.S. indices, gold, silver, and bonds – have historically performed in the two months leading up to the election, which is roughly where we are now. In order to do this, we consulted our main source for research; Nasdaq Dorsey Wright. We looked at the returns from August 31st through October 31st of every election since 1976 and broke the returns out by which party the incumbent belonged to heading into the election. We did this to uncover if there were any notable differences there. The results of our analysis are below, along with some observations. The following chart and comments are from Nasdaq Dorsey Wright.

- The US Aggregate Bond Index is the only asset representative examined that has an average return in the black during the two-month time period before the last eleven presidential elections.

- Taking out the 2008 timeframe reveals that the incumbent party during the two months leading up to an election do not have a major effect on returns, especially when taking into account that the democratic party was incumbent during the technology bubble in 2000, which skewed returns for the democratic average further south.

- Removing 2008 from the averages still shows that the US Aggregate Bond Index is the best performing area with an average return of 1.70%, however, we note that the S&P 500 Index now sits just behind the bond representative with an average return of 1.46%.

- Gold and Silver saw their best performance in 1976, which was a year of significant inflation.

While not a large enough sample size to draw any statistically robust conclusions, the data doesn’t appear to show any discernible bias to one asset class or another in the runup to the election. We also found no consistent differences based on which party the incumbent belonged too and differences in the averages seem to be more happenstance. The key takeaway here is that we’re probably better served to base our investment decision making on the economic and market indicators.

If you have any questions, please let me know.

The Markets and Economy

- Economists from the second largest bank in the country (Bank of America) predict that the U.S. economy will not recover until early 2023.

- According to the Brookings Papers on Economic Activity, 33% of pandemic-driven layoffs in the U.S. between March thru May of this year will be permanent. With about 16.3 million unemployed as of July, that means over 5.4 million will never return to their old jobs at their former employers.

- According to the Treasury Department, as of the end of June, the U.S. government’s Debt-to-GDP ratio was 137%. $26.5 trillion of government debt divided by our $19.4 trillion economy.

- Sales of new homes jumped again in July as the housing market continues to gain traction following a downturn in the spring caused by pandemic-related lockdowns. According to the Commerce Department, sales of new homes rose 13.9%. This comes on the heels of big increases in May and June.

- Global trade had weakened before the pandemic, hobbled by trade tensions and fresh tariffs. But over the last few weeks, signs have emerged of a rebound in the movement of goods across national borders. Still, the disruptions in the supply chain are causing some governments to revisit their reliance on foreign-made goods. This is especially true for medical supplies as existing pipelines were woefully inadequate.

- The U.S. economy shrank 31.7% in the second quarter as Americans dealt with the effects of the pandemic. The Commerce Department had predicted the economy would contract 32.9%. Investors were glad for the slightly better-than-expected figure.

- The United Nations released a new policy brief outlining the pandemic’s global impact on the tourism industry. In it, they project losses to be around $1 trillion with 100 million jobs lost worldwide. Approximately one-in-ten people work in the tourism sector globally.

Offices in Chicago, Kansas City, St. Louis, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors.